Free Consultation | "NST is the Way to Go!"

Skip to content

Skip to content

At NST Law, we are dedicated to helping injured individuals and their families get the justice and compensation they deserve.

Expertise

Mr. Trotz has handled injury cases involving auto accidents, slip and fall, premises liability, and negligent security. Every day, Mr. Trotz represents those who have been injured and many of his clients have sustained traumatic and life-altering injuries.

Accidents in more densely populated areas, like Memphis, are becoming increasingly common due to the number of drivers on the road and many accompanying risk factors, including a rise in cell phone use while driving and impairment from drugs or alcohol. Memphis Car Accident Lawyers can help you navigate the complex legal process after an accident, ensuring your rights are protected.

Motor vehicle accidents can cause serious injuries requiring extensive medical care and leading to lost wages due to an inability to work during recovery, and sometimes permanently. If you or a loved one suffered injuries due to a car accident while driving in Memphis, a car accident attorney can help you learn about your legal rights and how to get financial compensation to cover your accident-related damages..

At Nahon, Saharovich & Trotz, our experienced Memphis personal injury attorneys can evaluate your case and provide you with legal advice to help you get the financial support you need to aid in your recovery.

Engaging the services of our NST Memphis Car Accident Lawyers can be the crucial step you need to take after being involved in a car accident. Our team of experienced attorneys is dedicated to protecting the rights and interests of our clients, ensuring they receive the compensation they deserve. By entrusting your case to NST, you gain access not only to our extensive knowledge of car accident laws and Memphis-specific regulations but also to a legal team that truly values community and character.

We go beyond the courtroom—NST is deeply committed to making a positive impact through community involvement initiatives that support local families and improve public safety across Memphis and the Mid-South. That same spirit of service drives our approach to legal advocacy, as outlined in our firm’s Six Pillars which guide everything from how we treat clients to how we fight for justice.

We meticulously investigate every aspect of your accident—gathering evidence, interviewing witnesses, and working with trusted experts to build a compelling case. Our attorneys are skilled negotiators and fierce advocates, adept at handling insurance companies and maximizing settlements. We also provide personalized attention throughout the legal process, helping you confidently navigate every step forward. With an NST Memphis Car Accident Lawyer by your side, you can rest assured that your rights are protected—and that we’ll fight tirelessly to secure the best possible outcome for you.

At NST Law, our car accident legal team has over 30 years of experience working with insurance companies and other parties named in accident claims. We are familiar with important statutes of limitations, court processes and deadlines, and evidence requirements. At our car accident law firm in Memphis, we put this experience to work for you and can help:

You don’t have to go through the aftermath of a car accident alone. Before filing your injury claim after a car accident, call us for your free consultation to learn more about your legal rights.

Our car accident attorneys in Memphis have years of experience working handling many different types of car accident cases, including:

Each type of accident presents unique challenges, and our team is prepared to investigate thoroughly, prove liability, and pursue full compensation. Over the years, we’ve secured significant results for our clients in these types of cases, including:

The amount of compensation you can receive depends on your ability to show the damages you sustained. Damages you can receive compensation for include physical, emotional, and property damages. A judge or jury can also consider other ways in which the accident impacts your life. It’s important to keep track of the following to maximize your potential payout:

There are several important steps that you can take immediately after a car accident to help preserve your legal right to recover damages:

Based on the Tennessee Department of Safety and Homeland Security statistics, the total number of crashes in Shelby County increased by almost 28% in the most recent decade, from 27,364 in 2010 to 35,022 in 2020. This total number of collisions includes fatal accidents, accidents resulting in non-fatal injuries, and accidents resulting only in property damage.

The overall number of traffic accidents in Shelby County reached its peak in 2019, with 39,436 total crashes. Deadly accidents, though, were much higher in 2021 at 261 compared to 155 in 2019.

In 2024, Shelby County ranked #1 for the fifth consecutive year in overall crashes, including both fatal accidents and those resulting in non-fatal injuries, among licensed drivers. As of March 2025, the year is on track to surpass 2024’s fatal accident numbers, with 251 fatalities reported in the first quarter, compared to 239 during the same period in 2024. See our breakdown of recent car accidents in Memphis for more insights into local crash trends.

All kinds of car accidents happen in Memphis, but statistics from the Tennessee Department of Safety and Homeland Security show the most common car accidents in the area involve speeding, driving under the influence, and drivers in a specific age range. More specifically, Shelby County ranked:

Common types of collisions include:

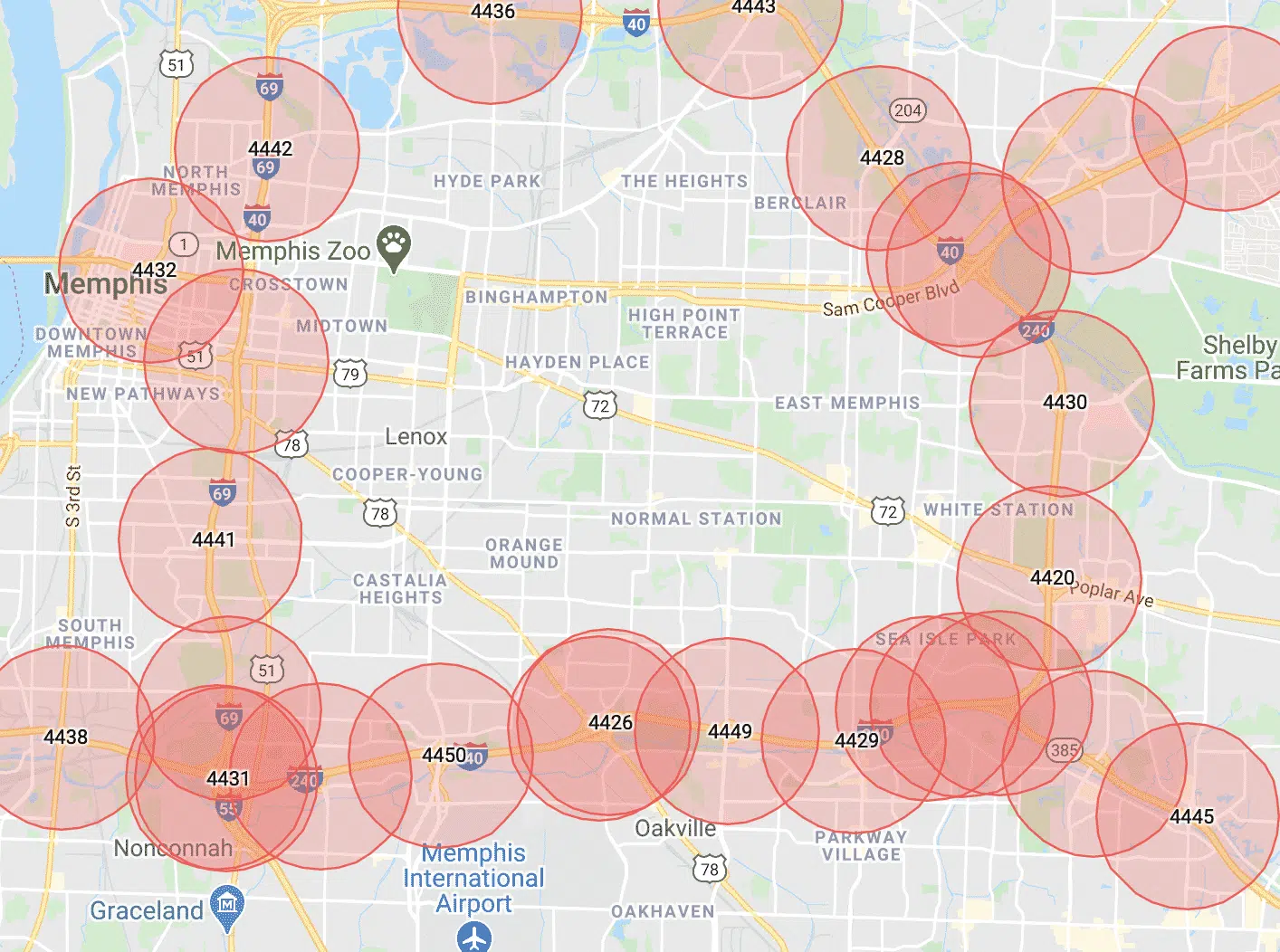

Some of the most dangerous intersections in Memphis include:

Generally, most accidents and congestion occur along the I-40/I-240 loop, especially around Union Avenue, Poplar Avenue, East Parkway, and South Parkway. You can see these traffic hotspots in the red images below:

Car accidents have many potential causes with a lot of different factors at play, including the weather, mechanical issues, and differences in the number of years of driving experience each driver has. The most common causes of car accidents include:

Each of these accident causes corresponds to the legal definition of negligent driving, supporting the elements of negligence required in a personal injury lawsuit.

Depending on the nature and severity of the car accident, injuries can range from minor to life-threatening, permanent, or deadly. Common injuries sustained in car accidents include:

Aside from the physical and emotional damages resulting from a car accident, there may be other damages involved in your case, such as property damage. Additional damages can include damage to your vehicle or items in your car at the time of the accident, damage to state property such as guardrails and signposts, or damage to other persons’ private property such as parked cars or real estate.

Tennessee has a “modified comparative negligence” statute. Under this law, you can still recover damages if you were less than 50% at fault for the car accident, but your compensation award will be reduced depending on your share of the blame.

For example, if a judge or jury determines you are 25% at fault for the accident and your compensation award totals $100,000 in damages, you will be able to receive $75,000. If your contribution to the cause of the accident is 51% or more, you cannot recover your damages. A personal injury lawyer can help review the facts of your specific case to decide if you have a valid claim for which you can receive compensation.

You need to collect as much relevant evidence as possible to support your claim and help you recover your losses. Necessary evidence might include:

A car accident lawyer can help you gather and review all necessary evidence to support your claim to ensure you receive fair compensation for your injuries.

If your loved one passes away due to injuries sustained in a car accident, you can bring a wrongful death lawsuit against the other driver. These types of cases are often complicated, so it’s beneficial to retain an attorney to help you.

Wrongful death lawsuits cannot take away the pain of losing your loved one, but seeking compensation for economic and non-economic damages related to your loss can help ease any financial burden resulting from:

You may also be able to recover damages for the emotional effects of losing your loved one, including compensation for:

Lastly, depending on the facts of your case, you may be able to obtain punitive damages intended to punish the responsible party and deter similar behavior in the future. Punitive damages are usually only awarded in the most egregious cases, where drivers are grossly negligent or intentionally harmful. You must show this egregious behavior by clear and convincing evidence (a high burden of proof) to be eligible for this additional compensation.

It’s common to assume that your insurance company is on your side, but you should always be cautious when dealing with insurance providers after a car accident. It’s important not to rely on your insurance company to get you a reasonable settlement offer. Insurance companies often protect their interests first and try to resolve claims as quickly as possible for as little money as possible, thereby often offering you a settlement less than the actual value of your claim.

Before settling with an insurance company, speak with a car accident attorney to ensure you receive fair compensation.

Related: If I have been involved in an auto accident, should I speak with the insurance company?

Different types of claims can arise from car accidents, and the statute of limitations can vary for each:

If you want to assert a claim or file a civil lawsuit after a car accident, hiring a Memphis Car Accident Lawyer is crucial to ensure you receive a fair settlement to compensate for your injuries and other damages. Your attorney will handle multiple aspects of your case to make the process as smooth and effective as possible, including:

Communicating with Insurance Companies and Legal Counsel: Insurance companies often try to convince you to accept a lower settlement offer that doesn’t reflect the full extent of your damages. Your lawyer will advocate for your best interests and negotiate to secure the compensation you deserve.

Gathering Necessary Evidence: A skilled car accident attorney understands the types of evidence needed to support your claim and can help you collect, evaluate, and preserve it for future settlement or trial. This may include obtaining documentation from you, sending discovery requests to the other parties, or deposing the other driver.

Filing Legal Documents on Time: Tennessee’s statute of limitations for filing personal injury claims is short, which makes timely filing crucial. Your attorney will track all deadlines and ensure your lawsuit is filed before time runs out, preventing the court from dismissing your case due to untimely filing.

At Nahon, Saharovich & Trotz, we’ve helped countless clients achieve the compensation they deserve. Don’t just take our word for it—hear from some of our satisfied clients:

NST was the best. They kept me updated on everything going on with my case. They were fast and very patient, guiding me through the entire process. If you ever need legal services regarding car accident lawsuits or anything else, please give them a call!

I was in Tennessee visiting when we were rear-ended. We immediately sought representation from NST Law Firm. Living in California, NST kept me updated on the status of my case from day one. Ms. Margaret was exceptional with her communication. Anytime I had questions, they were very responsive, and I felt at ease knowing NST Law Firm was there for me. I would like to thank them for their professionalism and promptness throughout this time. I would definitely recommend their services.

Parker and his team were outstanding to work with and kept me in the loop throughout the entire process. I wouldn’t use any other firm—NST is the best in the business!

Instead of charging an hourly rate for legal services, car accident attorneys typically receive payment via a contingency fee arrangement. This payment plan means that your attorney only gets paid if you receive compensation, whether by settlement or trial award. Thus, your attorney’s payment is “contingent” on a satisfactory outcome for you.

Contingency fees can vary and are a percentage of your total recovery. This percentage usually ranges from 30-40%, depending on the complexity of your case and whether it’s likely to settle or move on to trial. If your claim is more straightforward, your contingency rate may be lower than the average amount.

You may still have to pay for the costs of litigation regardless of whether your claim is successful. These costs usually include filing fees, deposition costs, expert witness fees, and other court costs or miscellaneous fees for obtaining evidentiary records.

If you recover money from your case, your lawyer may deduct these costs from your total compensation after extracting their contingency fee. For example, if your contingency fee is 33%, your litigation costs are $10,000, and the court awards you $100,000, your attorney would receive $43,000 for fees and expenses, and you would receive the remaining $57,000.

Keeping in mind the statute of limitations of one year for personal injury and wrongful death suits, it’s important to contact an attorney as soon as possible after a car accident. The law firm you retain will need time to gather information about your case and analyze your claim’s validity before filing a lawsuit. Contacting a car accident attorney as soon as possible after an accident can help preserve your legal right to seek compensation.

If you or your loved one suffered injuries in a car accident, contact our legal team at Nahon, Saharovich & Trotz Personal Injury Attorneys today for a free consultation and to learn about your options to receive fair compensation.

Founding Member – Senior Partner

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Founding Member – Senior Partner

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Founding Member – Senior Partner

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Founding Member – Senior Partner

Phone: (731) 427-5550

Attorney

Phone: (865) 684-1000

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (865) 684-1000

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Contact us for a free consultation now so that we can review your case and decide how we can best help you.