Memphis Nursing Home Negligence Lawyers

At NST Law, we are dedicated to helping injured individuals and their families get the justice and compensation they deserve.

Expertise

Mr. Trotz has handled injury cases involving auto accidents, slip and fall, premises liability, and negligent security. Every day, Mr. Trotz represents those who have been injured and many of his clients have sustained traumatic and life-altering injuries.

- Injury Attorneys Representing Residents in Memphis and the Surrounding Region

- Nursing Home Abuse & Neglect Verdicts & Settlements

- Taking Legal Action for Nursing Home Negligence or Abuse

- Testimonials from our Memphis clients

- Our Memphis Nursing Home Negligence Lawyers

- Enlist a Nursing Home Negligence Lawyer in the Memphis Area or Elsewhere

Injury Attorneys Representing Residents in Memphis and the Surrounding Region

All elderly people deserve respect and care. Many families assume and trust that when they put a family member in a nursing home, their loved one will receive adequate personal and medical attention. Unfortunately, many nursing homes are understaffed or staffed by people who are inadequately trained to work with the elderly. As a result, many residents are vulnerable to abuse and neglect. If you or a loved one has been subjected to this reprehensible conduct, our Memphis nursing home negligence lawyers can help you explore your legal options and assert your rights. At Nahon, Saharovich & Trotz, the largest personal injury firm based in Tennessee, we regularly try cases to juries and will not hesitate to bring your claim to trial if you do not receive an appropriate settlement offer. We have over 30 years of experience as injury attorneys representing victims in Tennessee, Mississippi, Arkansas, Kentucky, and Missouri.

Nursing Home Abuse & Neglect Verdicts & Settlements

$300,000: NEGLIGENCE BY NURSING HOME CAUSING BED SORE IN A PATIENT

Our firm represented the estate of a 76-year-old woman in a case involving nursing home neglect. The woman developed a large bedsore from being left in one position for prolonged periods while admitted at a nursing home. She died as a result of the severity of her bedsore. Our firm investigated this claim and enlisted medical experts who linked the death to the bedsore suffered at the nursing home. Liability in this case was fiercely disputed, and our team of lawyers began preparing the case for trial. During the course of the extended litigation, our firm successfully fought the defendant’s attempts to submit this claim to arbitration. We continually developed the case through motion practice, hearings and depositions of medical experts, treating physicians and a multitude of witnesses. Two days before the trial of this case was scheduled to begin, our firm was able to secure a settlement for our client in the amount of $300,000.00.

See more of our nursing home case results!

Taking Legal Action for Nursing Home Negligence or Abuse

If your loved one is in a nursing home, you should be alert to potential signs of neglect or abuse. Some common indicators include bedsores, unexplained fractures or bruises, malnutrition, dehydration, and wandering. For example, bedsores develop in people who are not turned every two hours to avoid putting undue pressure on the legs, feet, and buttocks. When a resident loses excessive weight, has parched lips, or develops many urinary tract infections, these may be signs of malnutrition and neglect.

A nursing home that is improperly administered or staffed may be held liable if its failure to use reasonable care and comply with laws results in an injury to a resident. State and federal laws prohibit neglect or abuse of the elderly and disabled in nursing homes (CMS Nursing Home Regulations). In Tennessee, nursing home administrators must have at least one of three types of certification in order to take on an administrator role. Meanwhile, nursing home staff members must undergo criminal background checks if they provide direct patient care or have direct patient contact. This process includes fingerprinting and authorizing the nursing home to obtain information pertaining to criminal history.

Nursing home abuse consists of the infliction of injuries, mental anguish, or pain on a resident. All employees are required to report an incident or suspicion if they have reasonable cause to believe that another employee has abused a resident.

Residents have many legal rights under both state and federal laws. For example, all nursing home residents are entitled to receive nutrition meals, snacks, and hydration. Moreover, each nursing home must employ an organized nursing service for 24 hours a day. The service should be furnished or supervised by a registered nurse. A licensed registered or practice nurse needs to be on duty to care for residents at all times. Two nursing staff must also be on duty at all times. Furthermore, a physician and a dentist must be available. If the nursing staff or a physician deviates from the accepted standards and practices of the medical community in providing treatment to a resident, it may be appropriate to also bring a medical malpractice claim.

Testimonials from our Memphis clients

Steven and Seth went above and beyond. Dessirae Hoffman was also an amazing paralegal who made everything easy. Thank you NST for being so helpful during a bad time.

Our Memphis Nursing Home Negligence Lawyers

Founding Member – Senior Partner

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Founding Member – Senior Partner

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Attorney

Phone: (901) 683-7000

Founding Member – Senior Partner

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Founding Member – Senior Partner

Phone: (731) 427-5550

Attorney

Phone: (865) 684-1000

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (865) 684-1000

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Attorney

Phone: (731) 427-5550

Enlist a Nursing Home Negligence Lawyer in the Memphis Area or Elsewhere

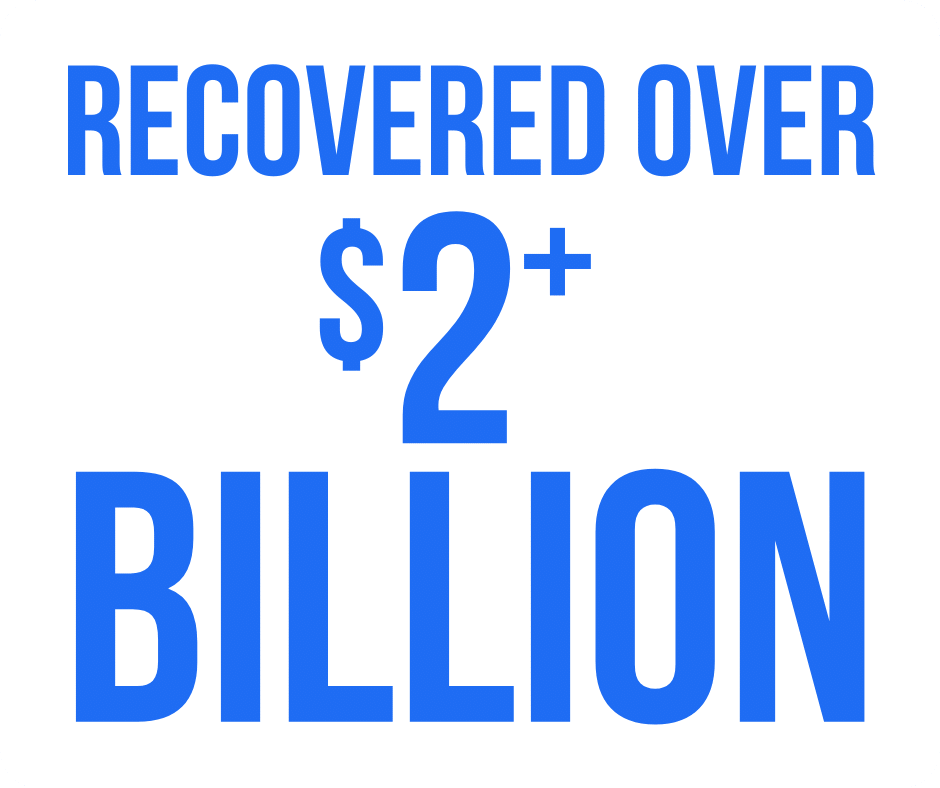

If you have been hurt or lost a loved one due to nursing home neglect or abuse, the experienced Memphis nursing home negligence attorneys at Nahon, Saharovich & Trotz may be able to represent you in a lawsuit. Our staff of 30 attorneys and over 100 staff members have recovered over $1.5 billion in settlements and verdicts. We provide representation to people in Memphis, Nashville, Knoxville, Chattanooga, Jonesboro, Little Rock, Jackson, Meridian, Tupelo, Columbus, Grenada, Starkville, Oxford, Hayti, and Caruthersville, among other areas of Tennessee, Mississippi, Arkansas, Missouri, and Kentucky. Contact our office toll-free by calling 800-529-4004 or by completing our online form to schedule your free appointment. Our firm also represents people who are searching for a medical malpractice attorney or assistance with any other type of personal injury claim.

We look forward to discussing with you why NST is the way to go.

Skip to content

Skip to content