Memphis

Car Accident Lawyers

Mr. Trotz was recognized from 2019-2024 as a Super Lawyers Mid-South Rising Star. Mr. Trotz is also a member of the Young Lawyers Division of the Memphis Bar Association, Memphis Bar Association, Tennessee Bar Association, and the Tennessee Trial Lawyers Association where he serves on the Executive Committee. READ OUR EDITORIAL GUIDELINES

Mr. Trotz was recognized from 2019-2023 as a Super Lawyers Mid-South Rising Star. Mr. Trotz is also a member of the Young Lawyers Division of the Memphis Bar Association, Memphis Bar Association, Tennessee Bar Association, and the Tennessee Trial Lawyers Association where he serves on the Executive Committee. READ OUR EDITORIAL GUIDELINES

Accidents in more densely populated areas are increasingly common due to the number of drivers on the road and the many accompanying risk factors, including a rise in cell phone use while driving and impairment from drugs or alcohol.

Motor vehicle accidents can cause serious injuries requiring extensive medical care and leading to lost wages due to an inability to work during recovery and sometimes permanently. If you or a loved one suffered injuries due to a car accident in Memphis, a car accident attorney can help you learn about your legal rights and how to get financial compensation to cover your accident-related damages.

At Nahon, Saharovich & Trotz, our experienced Memphis personal injury attorneys can evaluate your case and provide you with legal advice to help you get the financial support you need to aid in your recovery.

Table Of Contents

- Benefits of Hiring an NST Memphis Car Accident Lawyer

- What does a car accident lawyer do?

- What types of car accidents do car accident attorneys handle?

- What types of damages can I receive compensation for?

- How common are car accidents in Memphis?

- Most Common Types of Car Accidents in Memphis

- Dangerous Intersections in Memphis

- What are the causes of car accidents in Memphis?

- Common Injuries After a Car Accident

- How can I prove my damages?

- What if my family member dies in a car accident?

- What should I do after a car accident?

- How long do I have to file a claim?

- Do I need a Memphis car accident lawyer

- How much does a Memphis car accident lawyer charge?

- When should I contact a Memphis car accident law firm?

Benefits of Hiring the NST Memphis Car Accident Lawyers

Engaging the services of our NST Memphis Car Accident Lawyers can be the crucial step you need to take after being involved in a car accident. Our team of experienced attorneys is dedicated to protecting the rights and interests of our clients, ensuring they receive the compensation they deserve. By entrusting your case to an NST lawyer, you can access our vast knowledge of car accident laws and regulations specific to Memphis. We meticulously investigate every aspect of the accident, gathering evidence, interviewing witnesses, and working with experts to build a strong case on your behalf. Our lawyers are skilled negotiators and fierce advocates, adept at handling insurance companies and maximizing settlements. We provide personalized attention and guidance throughout the legal process, helping you easily navigate complex legal procedures. With an NST Memphis Car Accident Lawyer by your side, you can rest assured that your rights are protected, and we will tirelessly fight to achieve the best possible outcome for you.

What does a Memphis car accident lawyer do?

At NST Law, our car accident legal team has over 30 years of experience working with insurance companies and other parties named in accident claims. We are familiar with important statutes of limitations, court processes and deadlines, and evidence requirements. At our car accident law firm in Memphis, we put this experience to work for you and can help:

- Collect and organize necessary evidence, including witness statements, police reports, and expert statements supporting your car accident claim

- Communicate with the insurance companies and the other driver’s attorney

- Contact your various medical providers to obtain complete medical records and additional information about your treatment and prognosis to support your claim for damages

- Negotiate a better settlement for you

You don’t have to go through the aftermath of a car accident alone. Before filing your injury claim after a car accident, call us for your free consultation to learn more about your legal rights.

Types of Cases Our Memphis Car Accident Lawyers Handle

Our car accident attorneys in Memphis have years of experience working handling many different types of car accident cases, including:

What types of damages can I receive compensation for?

The amount of compensation you can receive depends on your ability to show the damages you sustained. Damages you can receive compensation for include physical, emotional, and property damages. A judge or jury can also consider other ways in which the accident impacts your life. It’s important to keep track of the following to maximize your potential payout:

- All medical expenses related to the accident: Keep copies of your medical records and bills related to injuries you sustained in the accident.

- Current and future losses in income: Keep a record of any days you needed to take off from work due to your injuries and recovery. If you suffered serious or permanent injuries and can no longer do your job, you can calculate the income you would’ve made if you were able to continue working.

- Loss of consortium or companionship: This type of damage is especially significant in wrongful death cases and accounts for the loss of your loved ones’ familial contribution and companionship.

- Receipts for property damages: Keep your receipts from car repairs or rentals required if the accident totaled your car or it was in the shop for an extended time.

- Non-economic damages: These damages include the pain and suffering you endured or are continuing to endure after the accident. If you feel emotionally distressed, anxious, or unable to move forward due to your accident, it’s important to speak with a mental health specialist. If you do see a therapist, record how many visits you attend and the amount spent on co-pays or prescriptions.

What should I do after a car accident?

There are several important steps that you can take immediately after a car accident to help preserve your legal right to recover damages:

- File a police report: A police report can help establish liability and helps document all parties’ contact information, insurance information, and vehicle information for future use. You’re also required to report car accidents to the Tennessee Commissioner of Safety if someone died, suffered injuries, or if property damage totaled more than $1,500.

- Get the other driver’s information: Make sure to get the name and contact information of the other driver or drivers involved in the accident or any witnesses. Also, try to get the other driver’s vehicle and insurance information.

- Document the accident scene and any property damage: Take photos of both vehicles from several angles to document any interior or exterior damage. It can also be helpful to take pictures of the intersection and the road where the crash occurred, and any other property damage resulting from the accident.

- Seek medical care: If you have injuries or suspect you might be injured, seek medical attention immediately. Follow the instructions of all emergency personnel, including following up with your primary doctor if told to do so. It’s vital to seek treatment to document your injuries resulting from the accident, even if the only injuries sustained are cuts and bruises. Sometimes, injuries are not readily apparent, so it’s always a good idea to get yourself checked out by a doctor.

- Contact a personal injury attorney to go over the facts of your case, learn about your legal rights, and decide the next steps to seek compensation for your injuries and damages.

How common are car accidents in Memphis?

Based on the Tennessee Department of Safety and Homeland Security statistics, the total number of crashes in Shelby County increased by almost 28% in the most recent decade, from 27,364 in 2010 to 35,022 in 2020. This total number of collisions includes fatal accidents, accidents resulting in non-fatal injuries, and accidents resulting only in property damage.

In the last five years, the overall number of traffic accidents in Shelby County reached its peak in 2019, with 39,436 total crashes. Deadly accidents, though, were much higher in 2020 at 250 compared to 155 in 2019.

In 2020, Shelby County ranked #1 in overall crashes (including fatal accidents and those resulting in non-fatal injuries) among licensed drivers. As of March 31, 2021, 7,954 total crashes happened in Shelby County, with less than 1% resulting in deaths and nearly 23% involving non-fatal injuries.

Most Common Types of Car Accidents in Memphis

All kinds of car accidents happen in Memphis, but statistics from the Tennessee Department of Safety and Homeland Security show the most common car accidents in the area involve speeding, driving under the influence, and drivers in a specific age range. More specifically, Shelby County ranked:

- 64th in the state for car accidents resulting from speeding

- 71st in the state for accidents involving a drunk driver

- 2nd in the state for accidents involving a driver between the ages of 15 and 24

- 3rd in the state for accidents involving a driver over the age of 65

Common types of collisions include:

- Head-on collisions: Head-on collisions most often occur when an impaired or distracted driver veers into an oncoming lane of traffic and are most likely to have deadly outcomes.

- Rear-end collisions: Also commonly known as fender benders, read-end collisions can range from relatively minor to severe and are often due to distracted driving or drivers following too closely.

- T-bone accidents: T-bone accidents are common at intersections when one driver fails to yield the right of way to another driver, running a stop sign or a red light.

- Single-vehicle crashes: Single-vehicle crashes involve drivers crashing into guardrails, signposts, trees, or buildings. They can occur for various reasons, but most often because of distracted driving, impaired driving, or falling asleep behind the wheel.

Dangerous Intersections in Memphis

Some of the most dangerous intersections in Memphis include:

- Lamar and Holmes

- South Lauderdale and Mallory (near the FedEx hub)

- East Shelby Drive and Getwell

- East Shelby Drive and Lamar

- Winchester Road and Hacks Cross Road

- Summer Avenue and Sycamore View

- Union Avenue and McLean

- I-40 and Canada Road

- I-40 and Chambers Chapel

A recent study based on the number of 18-wheelers and commercial truck drivers operating their trucks while on cell phones showed that two Memphis intersections, Compress Drive and S Lauderdale Street and E Holmes Road and Lamar Avenue, ranked among the nation’s most dangerous.

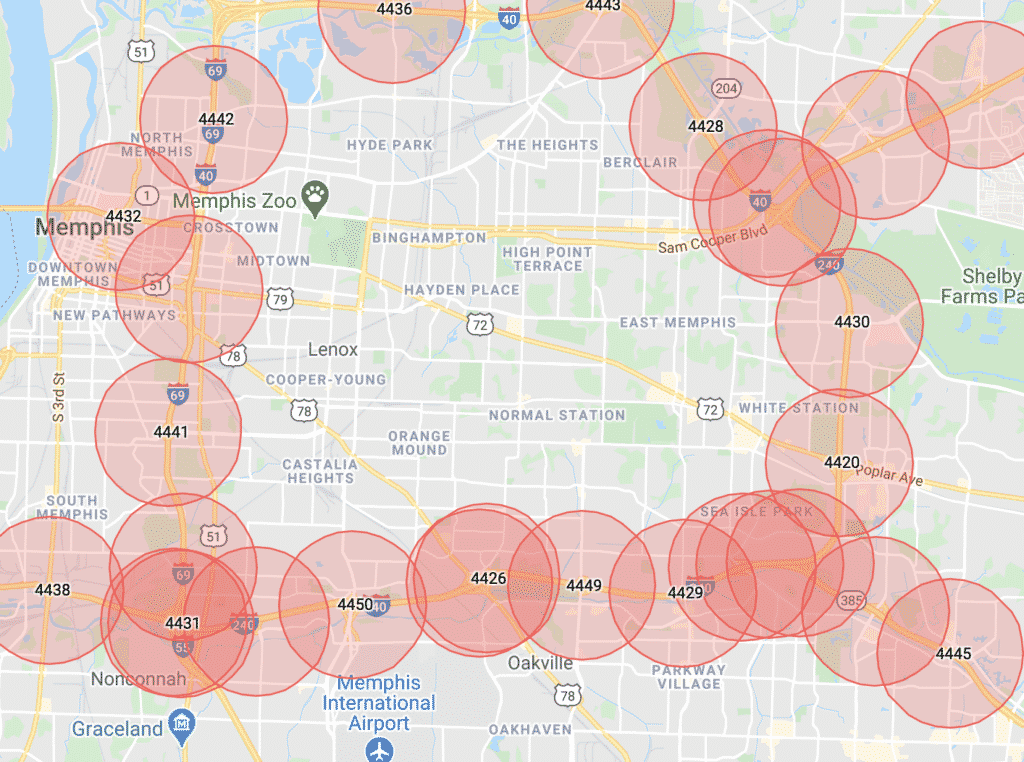

Generally, most accidents and congestion occur along the I-40/I-240 loop, especially around Union Avenue, Poplar Avenue, East Parkway, and South Parkway. You can see these traffic hotspots in the red images below:

What are the causes of car accidents in Memphis?

Car accidents have many potential causes with a lot of different factors at play, including the weather, mechanical issues, and differences in the number of years of driving experience each driver has. The most common causes of car accidents include:

- Speeding: Most highways in Tennessee have a speed limit of 55–70 miles per hour, and if not otherwise posted, the speed limit on most roads in Memphis is 25 miles per hour. Driving over the speed limit puts you at risk of hitting pedestrians and other motorists or losing control of your vehicle.

- Drunk driving: Drunk driving accidents often result in more severe injuries because drunk drivers generally take greater risks behind the wheel. The legal limit for allowable Blood Alcohol Content (BAC) when driving is 0.08, but impairment can still affect a driver below that threshold.

- Ignoring the rules of the road: Violating driving laws can include rolling through or failing to stop at stop signs or red lights, not properly signaling when turning or changing lanes, driving the wrong way or on the wrong side of the street, and failing to use your headlights during times of poor visibility.

- Road rage: Road rage happens when drivers get overly angry at each other, often when pulling out or changing lanes, etc., leading to serious accidents. Signs of road rage include making obscene gestures, yelling at other drivers, threatening or challenging other drivers, and otherwise lashing out verbally or physically while driving.

- Distracted driving: Distracted driving happens any time something is taking your attention away from the road. Examples of distractions include using your phone, eating or drinking, changing the radio station, or even talking to a passenger in your car. Emotional driving (e.g., crying, thinking hard about a circumstance in your life, etc.) can be a mental distraction leading to an accident.

- Fatigue: Fatigue can be an issue for anyone on the road, especially early in the morning, late at night, or traveling long distances. People who are not well-rested and alert while driving risk falling asleep behind the wheel and causing an accident. Fatigue can also lead to delayed reaction times or result in an individual being entirely non-responsive to brake lights, red lights, and other traffic signals or events.

Each of these accident causes corresponds to the legal definition of negligent driving, supporting the elements of negligence required in a personal injury lawsuit.

Common Injuries After a Car Accident

Depending on the nature and severity of the car accident, injuries can range from minor to life-threatening, permanent, or deadly. Common injuries sustained in car accidents include:

- Cuts and bruises

- Muscle strain in the neck and back

- Concussion

- Herniated discs in the neck and back

- Nerve damage

- Broken bones, including broken ribs

- Traumatic brain injuries (TBIs)

- Spinal injuries

- Internal bleeding

- Crush injuries

- Compartment syndrome (painful swelling in an enclosed area causing severe soft tissue damage)

- Mental and emotional trauma, including post-traumatic stress disorder (PTSD)

Aside from the physical and emotional damages resulting from a car accident, there may be other damages involved in your case, such as property damage. Additional damages can include damage to your vehicle or items in your car at the time of the accident, damage to state property such as guardrails and signposts, or damage to other persons’ private property such as parked cars or real estate.

How can I prove my damages?

Tennessee has a “modified comparative negligence” statute. Under this law, you can still recover damages if you were less than 50% at fault for the car accident, but your compensation award will be reduced depending on your share of the blame.

For example, if a judge or jury determines you are 25% at fault for the accident and your compensation award totals $100,000 in damages, you will be able to receive $75,000. If your contribution to the cause of the accident is 51% or more, you cannot recover your damages. A personal injury lawyer can help review the facts of your specific case to decide if you have a valid claim for which you can receive compensation.

You need to collect as much relevant evidence as possible to support your claim and help you recover your losses. Necessary evidence might include:

- Police reports

- Information for other parties involved, including drivers license number, vehicle information, insurance information, and contact information

- Photographs or videos of the scene of the accident

- Name and contact information of witnesses, if any

- Medical records related to the accident

- Receipts for car repairs related to the accident

- Other evidence obtained through the discovery process

A car accident lawyer can help you gather and review all necessary evidence to support your claim to ensure you receive fair compensation for your injuries.

What if my family member dies in a car accident?

If your loved one passes away due to injuries sustained in a car accident, you can bring a wrongful death lawsuit against the other driver. These types of cases are often complicated, so it’s beneficial to retain an attorney to help you.

Wrongful death lawsuits cannot take away the pain of losing your loved one, but seeking compensation for economic and non-economic damages related to your loss can help ease any financial burden resulting from:

- Emergency room expenses or other medical expenses incurred before your loved one’s death

- Funeral expenses

- Lost income or employment benefits due to your loved one’s passing

You may also be able to recover damages for the emotional effects of losing your loved one, including compensation for:

- Pain and suffering

- Loss of consortium

- Loss of companionship

- Loss of enjoyment of life

Lastly, depending on the facts of your case, you may be able to obtain punitive damages intended to punish the responsible party and deter similar behavior in the future. Punitive damages are usually only awarded in the most egregious cases, where drivers are grossly negligent or intentionally harmful. You must show this egregious behavior by clear and convincing evidence (a high burden of proof) to be eligible for this additional compensation.

It’s common to assume that your insurance company is on your side, but you should always be cautious when dealing with insurance providers after a car accident. It’s important not to rely on your insurance company to get you a reasonable settlement offer. Insurance companies often protect their interests first and try to resolve claims as quickly as possible for as little money as possible, thereby often offering you a settlement less than the actual value of your claim.

Before settling with an insurance company, speak with a car accident attorney to ensure you receive fair compensation.

Related: If I have been involved in an auto accident, should I speak with the insurance company?

How long do I have to file a claim after a crash in Memphis?

Different types of claims can arise from car accidents, and the statute of limitations can vary for each:

- Personal injury: If you experience physical injuries in a car accident, you only have one year from the date of the accident to file a lawsuit. If you miss that deadline, the court can throw out your claim and bar you from seeking compensation.

- Wrongful death: Wrongful death cases are also subject to a one-year statute of limitations. The difference with a wrongful death lawsuit is that the time begins tolling on the date of the victim’s death rather than the date of the accident. Sometimes, these dates are not the same if the victim spends a period in the hospital before passing.

- Property damage: Property damage claims have a three-year statute of limitations. These claims include damage done to your car or real estate. If you suffered injuries in the same accident, you’ll likely want to bring both the personal injury claim and the property damage claim at the same time. If that’s the case, you’ll still need to adhere to the SOL for personal injuries.

Do I need a Memphis car accident lawyer?

If you want to assert a claim or file a civil lawsuit after a car accident, you need to hire a Memphis car accident lawyer to help you receive a fair amount to compensate you for your injuries and other damages. Your car accident attorney can:

Handle communications with insurance companies and legal counsel for the opposing parties: Insurance companies often try to convince you to take a lower settlement offer than what’s fair, acting in their own best interest. Your attorney will advocate for you to get you the compensation you deserve.

Obtain necessary evidence: A car accident attorney knows what evidence you need to support your claim and can help you gather, evaluate, and maintain it for future settlement or trial. Your attorney might need to obtain documentation from you in addition to sending discovery requests to the other parties or deposing the other driver.

Timely file your legal documents: Tennessee has a very short statute of limitations for filing personal injury claims. Your attorney will keep track of when you need to file a lawsuit, so the court doesn’t dismiss your case for untimely filing.

How much does a Memphis car accident lawyer charge?

Instead of charging an hourly rate for legal services, car accident attorneys typically receive payment via a contingency fee arrangement. This payment plan means that your attorney only gets paid if you receive compensation, whether by settlement or trial award. Thus, your attorney’s payment is “contingent” on a satisfactory outcome for you.

Contingency fees can vary and are a percentage of your total recovery. This percentage usually ranges from 30-40%, depending on the complexity of your case and whether it’s likely to settle or move on to trial. If your claim is more straightforward, your contingency rate may be lower than the average amount.

You may still have to pay for the costs of litigation regardless of whether your claim is successful. These costs usually include filing fees, deposition costs, expert witness fees, and other court costs or miscellaneous fees for obtaining evidentiary records.

If you recover money from your case, your lawyer may deduct these costs from your total compensation after extracting their contingency fee. For example, if your contingency fee is 33%, your litigation costs are $10,000, and the court awards you $100,000, your attorney would receive $43,000 for fees and expenses, and you would receive the remaining $57,000.

When should I contact a Memphis car accident law firm?

Keeping in mind the statute of limitations of one year for personal injury and wrongful death suits, it’s important to contact an attorney as soon as possible after a car accident. The law firm you retain will need time to gather information about your case and analyze your claim’s validity before filing a lawsuit. Contacting a car accident attorney as soon as possible after an accident can help preserve your legal right to seek compensation.

If you or your loved one suffered injuries in a car accident, contact our legal team at Nahon, Saharovich & Trotz Personal Injury Attorneys today for a free consultation and to learn about your options to receive fair compensation.

Our Memphis Car Accident Lawyers

Contact us for a free consultation now so that we can review your case and decide how we can best help you.